Methods

Introduction

The "Community Benefit Insight (CBI)" website contains a list of hospital facilities (pediatric, acute care, and critical access hospitals) operated by a tax-exempt organization during one or more of the tax years beginning in 2010.

This Methods section is intended to provide a snapshot of the processes associated with:

- 1. Identifying and listing hospital facilities within the CBI criteria

- 2. Matching the IRS filings for the organizations that operate those facilities to individual hospitals

- 3. Matching the public facing hospital information CBI users search for with data in the CBI

1. Identifying and listing hospital facilities within the CBI criteria

The major data sources for hospital facility properties is the U.S. Centers for Medicare and Medicaid Services (CMS). However, there is no comprehensive list containing the types of organizations and facilities of interest to the CBI. To attain this information, the CBI team performs the following actions:

- From U.S. Internal Revenue Service (IRS) sources, generate a list of tax-exempt organizations that operate hospital facilities, and obtain the forms they file with the IRS

- From CMS sources, generate a list of hospital facilities that are within the CBI's scope

- Of those hospitals within CBI's scope, created a list that matches organizations (Employer Identification Number-EIN) to the facilities they operate (CMS Certification Number-CCN) by the tax-exempt organization's tax year

2. Matching the IRS filings for organizations that operate facilities to individual hospitals

Under the U.S. Internal Revenue Code, all tax-exempt organizations must file a Form 990 (F990) with the IRS every tax year. Tax-exempt organizations indicate on F990 if they operated one or more hospital facilities during the year. If an organization answers "yes" to this question, the organization is required to attach a Schedule H when it submits its F990. Thus, the IRS is a major source of information for data presented on the CBI. Additional elements about the hospital facility are also obtained from CMS and other publicly available sources. Matching the tax-exempt organization's Schedule H data to these ancillary data elements requires complex programmatic and manual matching of hospital addresses and names to develop an EIN-to-CCN crosswalk used to facilitate adding these data.

3. Matching the public facing hospital information CBI users enter with the data in the CBI database

CBI gives users flexible search options. Users can enter search terms for the name of a facility, a tax-exempt organization, or a system. Users can also select a set of facility-level characteristics (e.g., state, location in an urban area, number of licensed beds), and CBI will find all facilities that satisfy them. However, the name and even address of the facility commonly known to the public, such as the name on the side of the hospital building, may differ from the name used on IRS tax filings. Additionally, over the years a facility may change names as it re-brands, is merged with, or separates from larger organizations. When known, CBI searches through all known facility names. Currently a comprehensive list of all known names is not available.

Introduction

This web site, called "Community Benefit Insight (CBI)" provides transparency around community benefit policies and spending for tax-exempt organizations that operate hospital facilities. The CBI database contains a list of hospital facilities (pediatric, acute care, and/or critical access hospital) that were operated by a tax-exempt organization during one or more of the tax years 2010 – 2015. For each facility-year pair, CBI's database contains information about community benefit policies and spending for the tax-exempt organization that operated the facility that year. The information comes from forms that the tax-exempt organization files with the US Internal Revenue Service (IRS). The CBI does not adjust, delete or otherwise change the numbers appearing on the forms that the tax-exempt organizations file with the IRS.

There are challenges associated with 1) Enumerating all hospital facilities within the scope of the CBI 2) Finding the IRS filings for the organizations that operate them, 3) Matching the search terms CBI users enter to the information in the CBI database, and 4) Helping the user draw accurate and informed conclusions from the numbers and other data displayed. This Methods section is intended to help the user understand these challenges, understand the approach to coping with them and the rationale for choosing one approach over others.

Unless otherwise noted explicitly, CBI and this Methods section uses IRS vocabulary, and in particular, like the IRS, the CBI makes a distinction between a "tax-exempt organization that operates a hospital facility" and the facility. Neither the Tool nor this Methods section use other expressions in common parlance unless explicitly introduced and referenced against IRS terminology. These other expressions include but are not limited to "hospital", "hospital system", and "hospital network".

Sources of information about community benefit spending

This section of the Methods describes how the CBI obtains the data that eventually appear on screen.

Sources of information about spending and community benefit:

Under the United States Internal Revenue Code, all tax-exempt organizations must file a Form 990 (F990) with the IRS every tax year, where beginning and ending dates of the tax year are established by the organization. The organization identifies itself by name and its Employer Identification Number, or EIN. The EIN is a 9-digit numeric field that the organization uses in communications with federal, state and local authorities concerned with taxation for itself and employees.

There is one line on the F990 in which the tax-exempt organization indicates if it operated one or more hospital facilities during the ear. The IRS defines a "hospital facility" as a facility that, at any time during the organization's tax year, was required by state law to be licensed, registered or similarly recognized as a hospital.

If the tax-exempt organization answers "yes" to this question about operation of hospital facilities during the year, the organization is required to attach a Schedule H when it submits its F990 to the IRS. Schedule H has five parts. Parts 1-3 elicit information about the activities and policies of, and community benefit provided by, the tax-exempt organization that operates the facilities. In particular, for the organization to qualify for tax exemption in tax years beginning on or after March 23, 2010, organizations must report to the IRS their policies related to financial assistance, emergency medical care, billing and collections, and charges for medical care. This reporting requirement comes from the 2010 Affordable Care Act, or ACA. The ACA also stipulates that for tax years beginning on or after March 23, 2012, hospital facilities operated by tax-exempt organizations must conduct community health needs assessments (CHNA). The organizations report the status of their facilities' CHNAs on Part 5 of Schedule H.

Thus the IRS is a major source of information for the data presented on the CBI, and the IRS obtains these data because tax-exempt organizations are required by law to report the information for every tax year that they operate one or more hospital facilities. When the CBI shows the dollar amounts of community benefits spending each year, the CBI obtains these figures from Schedule H, Part 1, Question 7. When the CBI shows these dollars of community benefit spending as a percentage of "Total Functional Expenses", the CBI obtains functional expenses from Form 990, Section IX, Line 25a.

Data sources for properties of the hospital facilities: CMS

The Schedule H that organizations file with the IRS generally does not contain information about hospital facilities, beyond what is required by the Affordable Care Act. Because CBI users may wish to know if the facility of interest is urban or rural, small or large, a teaching hospital or not, the CBI needs to find that information about facilities from someplace other than Schedule H.

This type of information is available from sources other than the IRS. One source is the US Centers for Medicare and Medicaid Services (CMS). Every year, hospital facilities that are authorized to bill CMS for services provided to Medicare and/or Medicaid beneficiaries must file certain reports with CMS. Data from these reports are publicly available.

To get detailed information about hospital facilities, the CBI uses data from the following three files:

- CMS Provider-of-Services (POS) file. The POS file contains data on characteristics of each Medicare-approved hospital and other types of healthcare facilities, which are collected through CMS Regional Offices. On the file, facilities are identified by their CMS Certification Numbers (CCN); for each CCN, there is a facility name and address. The file also contains information about types of Medicare services the facility provides. In addition to information about active facilities, the POS file also contains historical information about facilities that have closed, merged with other facilities, have lost Medicare approval, and/or other conditions that lead CMS to designate it with a status of "terminated".

- CMS Healthcare Cost Reporting Information System (HCRIS). The entire set of HCRIS files contain data in cost reports for hospitals and other types of Medicare-certified institutional providers that are approved to bill Medicare for services. For its data to be included in the file, the facility's Medicare Administrative Contractor must submit the cost report, and the report must pass all all HCRIS edits. As with the POS file, facilities on the HCRIS file are numerically identified by the CCNs, and also contain a facility name and address.

Data sources for properties of the communities the facilities serve: Various

Because a hospital facility is intended to serve the community in which it resides, properties of the community also may be of interest, such as the percentage of families at or below the federal poverty line, its unemployment rate, etc. The CBI obtains these community-level properties from various sources, including the Kaiser Family Foundation

Methods to List the Hospital Facilities and the Tax-Exempt Organizations that Operate Them

Matching organizations (EINs) to the facilities they operate (CCNs): Overview

In general, a "row" of data in the CBI database represents a unique EIN-CCN-Year triplet, where:

- "EIN" means the Employer Identification Number, for the tax-exempt organization.

- "CCN" means "CMS Certification Number", sometimes called the Medicare Provider ID.

- "Year" is the tax-exempt organization's tax year

The CBI only shows information for tax-exempt organizations that operated hospital facilities, where the hospital facilities are short-term general and specialty hospitals, and/or children's hospitals, and/or critical access hospitals. The CBI shows information beginning in tax year 2010, and continues through the most recent tax year for which IRS data are available.

There is no extant list of EIN-CCN-YEAR triplets, limited to the types of organizations and facilities of interest to the CBI. In particular, the IRS has extensive information about the tax-exempt organizations, but has limited information about the facilities. CMS has extensive information about the facilities, but has limited information about the organizations that own/operate them. To get complete information about both the organizations and the facilities, limited to those within CBI scope, with an EIN-CCN pair for each tax year, it is necessary to move back and forth between multiple sources of information.

This section describes how the CBI team:

- From IRS sources, generates a list of tax-exempt organizations that operate hospital facilities, and obtains the forms they file with the IRS,

- From CMS sources, generates a list of hospital facilities that are within the CBI's scope, and

- Matches the hospital facilities to organizations, to produce information for all EIN-CCN-Year triplets

Generate list of tax-exempt organizations that operate hospital facilties

The CBI uses the following sources of information to enumerate EINs for tax-exempt organizations likely to operate hospital facilities:

- The IRS Business Master File contains cumulative information on all tax-exempt organizations in the US. (As of May 14, 2018, there were more than 1.68 million tax-exempt organizations recognized by the IRS. The CBI uses the following information from the IRS Business Master File to identify the tax-exempt organizations of interest:

- Codes on the master file that identify the type of organization, using the National Taxonomy of Exempt Entities (NTEE) (which is maintained by the National Center for Charitable Statistics). The CBI team retains EINs that have NTEE codes starting with E20 (Hospitals), E21 (Community Health Systems), E22 (General Hospitals), or E24 (Specialty Hospitals)

- The Master File also contains a Foundation Code. The CBI team retains EINs with a Foundation code of 12 (Hospital or Medical Research Organization)

- The IRS provides a file called Annual Extract of Tax-Exempt Organization Financial Data. This file lists EINs for tax-exempt organizations that attached a Schedule H to their F990s. The CBI team retains EINs for which the Annual Extract indicates that the organization attaches a Schedule H to its F990.

- Research files.

- The CBI is based on a prototype constructed by researchers at George Washington University and Northwestern University. Using manual methods, these researchers had constructed EIN-CCN-YEAR triplets for years 2010-2012, and for CCNs in a subset of states. To get started on a list of EINs, the CBI team used the EINs that appeared on the prototype.

- A group of researchers at University of Colorado in Denver (UCD) has constructed a crosswalk of EIN-CCN-YEAR triplets for 2010-2013, for research purposes. This team made their crosswalk available to the CBI team, which validated its methods by comparing lists generated by all methods.

Obtain the F990s and Schedules H for enumerated EINs.

The forms that tax-exempt organizations file with the IRS are publicly available resources. However, obtaining only the forms from organizations of interest, in a cost-effective manner, is challenging. Since approximately 2011, organizations increasingly have filed their forms electronically with the IRS. The IRS then makes them available in XML format from an Amazon Web Services (AWS) data repository. The CBI team developed code to search the AWS data repository automatically, using the EINs that met at least one of the selection criteria described above. To reduce information overload, the CBI team retained F990s and attached Schedule H if, on the F990, the organization indicated that it operated a hospital facility during the tax year.

Using this method, the CBI team would obtain F990s for all EINs on its list that filed electronically, but would not obtain F990s for the EINs on its list that filed on paper. The CBI team has estimated that each year, fewer than 5% of the tax-exempt organizations that operate hospital facilities submit their F990s to the IRS via paper. The CBI team would request these paper returns from a company named Guidestar, when it had a list of in-scope hospital facilities that couldn't be matched to hospital facilities on any of the electronically filed returns. More detail is provided in the sections below.

Generate a list of CCNs for short-term hospitals, children's hospitals and critical access hospitals.

From the CMS Provider-of-Services (POS) file, the CBI examines all CCNs, for all Medicare-approved healthcare facilities that year. The first two digits in the six-digit CCN identify the state. The next two digits in the CCN identify the provider type or category. The final two digits in the CCN are serial numbers.

The CBI reduces the full list of all Medicare-approved healthcare facilities to short-term hospitals (middle CCN digits 00-08), children's hospitals (middle CCN digits 33), and critical access hospitals (middle CCN digits 13). This same information is displayed in a POS field: PRVDR_CTGRY_SBTYP_CD.

The CBI finds names and addresses for each facility from:

- The CMS Provider-of-Services (POS) file.

- The CMS Healthcare Provider Cost Reporting Information System (HCRIS), and its subsystem for hospitals.

In the next step, the CBI team compares facility names and addresses from these sources to facility names and addresses as they appear on Schedules H. Because text strings representing addresses can have minor variations that make string-matching difficult; the CBI eliminates these nuisance variations by standardizing facility addresses using Google's Geocoding API, which converts a street address into geographic coordinates.

Match facilities from CMS sources to facilities on Schedules H

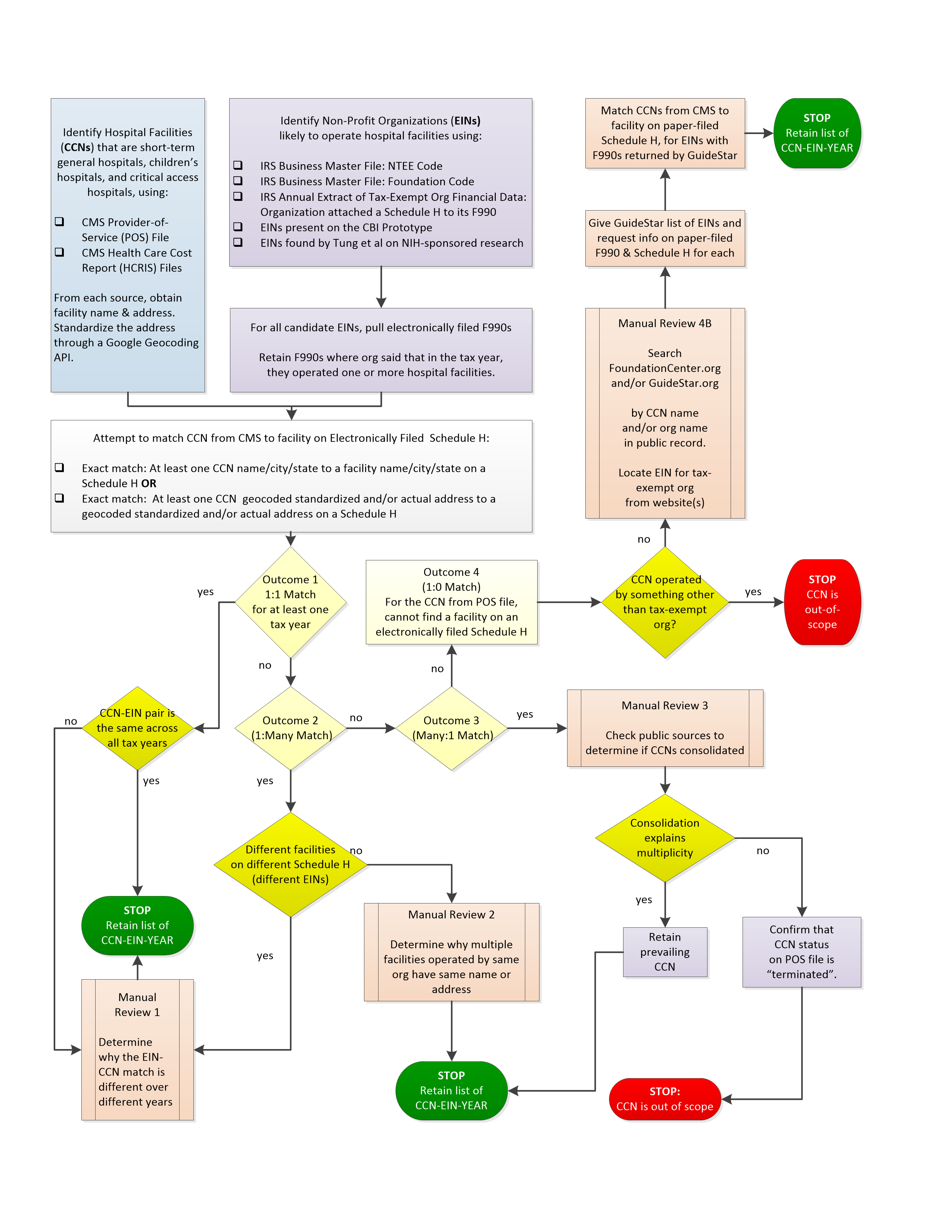

The CBI staff attempts to match CCN names found on the three data sources listed above to the facility names found on Part 5 Schedule H. There are four logically possible outcomes from this matching exercise. Each outcome, what it means, and the steps following from it, is shown on Figure 1.

Outcome 1. 1:1 Match. This means that the CCN from the non-IRS source matches to one facility on one Schedule H. Matches can be "exact", or determined by human review:

- Exact matches" are those in which

- The standardized address for the CCN from the non-IRS data sources match the standardized address from the Schedule H OR

- The text strings for the name/city/state from the non-CMS data sources are an exact match to the text strings for the name/city/state from the IRS.

- Human review matches:

- The name and address match exactly, but the EIN changes across tax years. This situation can arise if the tax-exempt organization that operates the facility changes from year to year. In these instances, the CBI team creates CCN-EIN-YEAR triplets that are specific to the CCN-EIN pair for each year.

- The facility name and address partially matched, and human review of web sites and other sources determined that they were for the same facility.

Outcome 2. 1:Many match. This means that the CCN from the non-IRS source matches to facilities on more than one Schedule H. In other words, the same CCN is operated by more than one tax-exempt organization over the years. These kinds of scenarios can arise with changes of ownership, mergers, etc. The CBI team investigates the history of the organizations, and the facilities they operated, and assigns CCN-EIN pairs by year, according to the results of the investigation.

Outcome 3. Many:1 match. This means that multiple CCNs match to a single facility on a Schedule H. This can occur if facilities consolidated, and the CCN for the consolidated entity is a CCN from one of the original entities. In such instances, the CMS POS file should show that the status for the other CCNs is "terminated". While the CBI team attempts to investigate facility consolidations, to confirm this explanation, it is possible that the investigation is inconclusive, but some CCNs will still have a terminated status on the CMS POS file. These CCNs are excluded from the CBI database because if they are terminated, they are out of scope.

Outcome 4: 1:0 match. This means that there is an in-scope CCN from a non-IRS source for which there is no matching facility on a Schedule H. There are two basic explanations for this outcome.

One is that the CCN was operated by an organization that was not tax-exempt. Such CCNs are out of scope for the CBI. The CBI team tests this hypothesis first. If the CMS sources both say that the facility was not operated by a tax-exempt organizations, and/or if the website for the facility indicates that it was not operated by a tax-exempt organization, then the CCN is removed from the list as being out of scope.

The other explanation is that the CCN was operated by a tax-exempt organization, but that the tax-exempt organization filed its IRS forms on paper, rather than electronically. As noted above, the matching exercise works with electronically filed Forms 990 and their attached Schedules H. As of 2015, approximately 96% of the tax-exempt organizations operating hospital facilities filed electronically with the IRS, but some continued to file on paper, and paper filing is not uncommon in years when ownership may change. The CBI staff requests copies of these paper returns from an organization called "Guidestar", which converts papers returns into images that 3rd parties can access for a fee.

Conclusion

When this exercise concludes, the CBI team will have EIN-CCN-Year triplets for tax-exempt organizations that operated in-scope hospital facilities for tax years 2010-2015, or the latest year in which data are available. For each year, information will be available for the tax-exempt organization (e.g. its community benefit spending, and policies), and for the facilities (e.g. number of licensed beds, urban vs. rural, type of facility). Tables 1a and 1b show the information that the CBI can share with the user, about tax-exempt organizations (Table 1a) and the hospital facilities they operate (Table 1b), for each tax year.

|

Table 1a. Information in the CBI Database about

Tax-Exempt Organizations that

Operate One or More Hospital Facilities |

||

|

Field |

Source |

Comment |

|

EIN |

IRS F990 |

EIN=Employer

Identification Number.

|

|

Organization name |

IRS F990 |

|

|

Organization address,

text form (street, city, state, zip) |

IRS F990 |

|

|

Organization address, standardized

form |

Derived from text

address |

This is the geographic

coordinators for the organization, derived from Google's Geocoding API. |

|

Tax Year Begin Date |

IRS F990 |

The organization can

define its own tax year. For most organizations, the tax year is 12 months. However, for administrative and/or organizational reasons, the organization may change its tax year occasionally, and during the shift, the year could be less than 12 months.

|

|

Tax Year End Date |

IRS F990 |

|

|

Number of months in

the tax year |

Derived |

|

|

Functional expenses |

IRS F990 |

Conceptually similar

to "operating expenses", this is a dollar amount the tax-exempt organization

enters on Form 990. Part IX, line 25, column A |

|

Number of hospital

facilities the organization operated in the tax year |

IRS Schedule H, Part 5 |

On the first line of

Part 5 of Schedule H, the organization enters the number of hospital

facilities it operated that year. |

|

Total community benefits |

IRS Schedule H, Part 1 |

All dollar amounts are

visible on the CBI website as dollars, or as percentage of functional

expenses. The user can toggle between them.

Note that all

information about community benefits spending is at the level of the

tax-exempt organization. The IRS does not contain spending information by individual facility. Approximately 65% of the facilities are "single children", meaning that the tax-exempt organization that operates it does not operate any other facilities.

For these organizations, facility-level spending can be inferred to be the spending by the organization.

However, another 35% of facilities are operated by organizations which operate other facilities.

|

|

Charity care |

||

|

Unreimbursed Medicaid |

||

|

Unreimbursed costs |

||

|

Community health

improvement services and community benefit operations |

||

|

Health professions education |

||

|

Subsidized health services |

||

|

Research |

||

|

Cash and in-kind

contributions to community groups |

||

|

Community building

activities - amt |

IRS Schedule H, Part 2 |

|

|

Bad debt |

IRS Schedule H, Part 3 |

|

|

Bad debt, attributable to

patients eligible for financial assistance |

IRS Schedule H, Part 3 |

|

|

Medicare Shortfall (negative value indicates surplus) |

Derived |

|

|

Table 1b. Information in the CBI Database about

Hospital Facilities that are

Operated by Tax-Exempt Organizations |

||

|

Field |

Source |

Comment |

|

CCN |

CMS POS |

CCN = CMS

Certification Number.

|

|

Facility Name 1 |

CMS POS |

The CBI database

contains text strings representing the facility name as found in each of the

three facility-level sources. Names across sources can differ. As described in more detail below, the CBI uses all names for each CCN to facilitate user searches of facilities.

|

|

Facility Name 2 |

CMS HCRIS |

|

|

Facility text address

1 (street, city, state, zip) |

CMS POS |

As above, each of the

three sources of facility information contains an address for the facility,

but they can differ. |

|

Facility text address 2

(street, city, state, zip) |

CMS HCRIS |

|

|

Facility standardized

address 1 |

Derived from text

address 1 |

Geographic

coordinators for each address, derived from Google's Geocoding API. |

|

Facility standardized

address 2 |

Derived from text

address 2 |

|

|

EIN-Year |

Derived |

The numeric identifier

for the tax-exempt organization that operated the facility in the given

year. The CBI team derives this using the methods described above. Note that it is possible for multiple CCNs to have the same EIN-Year pair. This means that in that tax year, that EIN operated all the indicated facilities.

|

|

Hospital bed size |

CMS POS |

Number of licensed

beds |

|

Church affiliation |

CMS POS |

|

|

Is it a children hospital? |

CMS POS |

|

|

Member of the Council of

Teaching Hospitals |

CMS POS |

|

|

Conducted community health

needs assessment (CHNA) |

IRS Schedule H, Part 5 |

As per a provision of the AHA, starting with tax years beginning on or

after 23MAR12, facilities operated by non-profit organizations were required

to prepare a community health needs assessment (CHNA). Tax-exempt organizations report their facilities' compliance with this requirement to the IRS, using Schedule H.

Part 5 is that portion of Schedule H where facilities operated by the

organization are listed by name.

Unlike the other parts of Schedule H, which capture information about the organization as a whole, Part 5 of Schedule H captures information about individual facilities.

|

|

CHNA defined the community

served |

IRS Schedule H, Part 5 |

|

|

CHNA took into account

input from persons who represent broad interests of the community served |

IRS Schedule H, Part 5 |

|

|

CHNA conducted with

multiple hospital facilities |

IRS Schedule H, Part 5 |

|

|

Hospital adopted

implementation strategy to address health needs of community |

IRS Schedule H, Part 5 |

|

|

Hospital executed

implementation strategy addressing health needs of community |

IRS Schedule H, Part 5 |

|

|

Hospital participated in

development of community-wide community benefit plan |

IRS Schedule H, Part 5 |

|

|

Written financial

assistance policy |

IRS Schedule H, Part 5 |

In addition to financial assistance policies set by the tax-exempt

organization, Part 5 of Schedule H captures information about financial

assistance policies set by individual facilities. |

|

Used federal poverty

guidelines to determine eligibility for free or discounted care |

IRS Schedule H, Part 5 |

|

|

FIPS county/state code |

CMS POS |

This 5-digit code uniquely identifies every US county (3-digits)

within every US state (2-digits). |

|

Urban location |

CMS POS -> Area Health

Resources File (AHRF) |

The FIPS county code for the county in which the facility is located

(by address) is available from the CMS Provider of Service file. This FIPS code is then used to find county-level properties from the Area Health

Resources File, maintained by the US Health Resources and Services

Administration. |

|

(County) per-capita income |

POS à AHRF |

|

|

(County) median household

income |

POS à AHRF |

|

|

(County) percent persons

in poverty |

POS à AHRF |

|

|

(County) percent persons

< 65 years of age without health insurance |

POS à AHRF |

|

|

(County) unemployment rate

for persons age 16 years and older |

POS à AHRF |

|

|

(State) implemented ACA

Medicaid expansion covering adults with incomes up to 138% Federal Poverty Line

– yes/no |

POS à Kaiser Family Foundation |

The FIPS state code is

used to gather this state-level information maintained by the Kaiser Family

Foundation |

|

(State) Limits income

eligibility to 76% of Federal Poverty Line, for parents of dependent children

enrolling in Medicaid – yes/no |

POS à Kaiser Family Foundation |

|

|

(State) There is a law

requiring report of community benefits |

POS à Kaiser Family Foundation |

|

Searches and Returns:

The CBI gives the user flexible search options. The user can enter a text string into a search box, where the text is for the name of a facility, a tax-exempt organization, or a system. The user can also select a set of facility-level characteristics and the CBI will find all facilities that satisfy them.

If the user enters a name, the CBI attempts to find matches to the name using the following process:

|

|

CBI compares

|

Facilities in the CMS POS File

|

Facilities in the CMS HCRIS file

|

Tax-exempt organizations from IRS F990

|

|---|---|---|---|---|

|

The user-entered string to:

|

The full name from:

|

Search 1

|

Search 2

|

Search 3

|

|

The user-entered string to

|

The starting letters in the names from:

|

Search 5

|

Search 6

|

Search 7

|

|

Any of the words in the user-entered string to

|

The starting word in the name from:

|

Search 9

|

Search 10

|

Search 11

|

|

All of the words (any order) in the user-entered string to

|

The full name from:

|

Search 13

|

Search 14

|

Search 15

|

|

Any of the words in the user-entered string to

|

The full name from:

|

Search 17

|

Search 18

|

Search 19

|

Each search is limited to 100 unique results, from which the user may choose. The results are presented in the order in which they were found. When presented, the user sees the facility name and city/state for the match. The CBI will also show the tax-exempt organization that operated the facility in the most recent tax year available.

The user can narrow the search results by selecting characteristics of interest, such as the state, or location in an urban area, or number of licensed beds.

Community benefit spending for hospital facilities operated by the same tax-exempt organization

For each tax year, approximately 62% of the in-scope hospital facilities are operated by unique tax-exempt organizations. For these facilities, the community benefit spending that the organization reports is equivalent to the community benefit spending for the facility.

However, another 38% of the in-scope facilities share their operating organization with at least one other facility . This can occur if the tax-exempt organization filing the F990 operates more than one hospital facility in that tax year, and lists all of them on the same Schedule H. It also can occur when the F990 is a "group return", filed by a single parent tax-exempt organization, which with other tax-exempt organizations are subsidiaries, and the subsidiaries do not file their own F990 returns. If the parent and subsidiaries operate hospital facilities, then all the facilities are listed on the Schedule H filed by the parent.

When one tax-exempt organization operates more than one hospital facility, the community benefit spending that the CBI reports is for all the facilities together, not just for any one of them. While there are various ways to estimate the spending for each facility, the CBI only reports what actually appears on the forms that organizations file with the IRS, and does not attempt to create estimates.

If the user searches the CBI for a facility which is operated by an organization that operates multiple facilities that year, the CBI informs the user that the community benefit spending shown is for the organization as a whole, not for the individual facility.

Existential change

From one calendar year to the next, it is possible for tax exempt organizations to merge, form different types of joint partnerships, cease operations and/or cease operating hospitals, change names, or change the beginning and ending dates of their tax-years. It also is possible for hospital facilities to experience existential change: They can merge with another facility or become acquired and operated by a different organization.

The CBI database maintains at its core the CCN-tax year pair, so most of these changes appear on the surface and do not impact the structure of the database. By default, the CBI displays the most recent year's information about the tax-exempt organization and the facilities it operates, giving the user the ability to display information about other years. If an existential change occurs, the CBI does not attempt to explain it, as monitoring such changes are beyond the scope of the project. However, the CBI does display the existential reality for every tax year.

There is only one type of existential change that can impact the structure of the database, and that is if the facility's CCN changes from one year to the next. This can occur if the facility changes its status to a Critical Access Hospital. CMS reporting requirements for Critical Access Hospitals differ from other types, and it is easiest for CMS and the facility to monitor correct reporting if the facility has a CCN that identifies it as a CAS. If this occurs, the previously-used CCN will disappear from the database and a new one will appear.

Strange numbers

When examining financial information for the same tax-exempt organization year to year, users may sometimes be confounded by seeing community benefit spending, and/or operating expenses, and/or other financial data, either much smaller or much larger than the same financial data for the same organization in other years. This can occur for the following reasons:

- There are errors on the Schedule H. The CBI makes no attempt to detect or correct errors.

- The beginning and ending dates of the organization's tax year changed, and while the change is underway, the organization may be reporting financial data for a tax year that is less than 12 months. For every organization-year pair, the CBI displays the beginning and ending dates for the tax years, so users can determine if this is the reason for unexpected numbers.

It is possible, although not common, for the community benefit spending to show negative values for one or more tax years. This can occur when the total net community benefit expense is negative, typically because the unreimbursed Medicaid costs are negative (e.g. the organization received more money for its Medicaid costs than expected).

It also is possible for tax-exempt organizations to have much smaller or larger community benefit spending numbers compared to peers that operate the same number of facilities, of comparable size, teaching status and/or location. While it is possible that these outliers represent errors and/or misreports on the original IRS source, it also is possible that the organizations with these unusual numbers actually perform differently from their peers.

The CBI does not attempt to identify or explain unexpected numbers. The CBI simply shows on screen the numbers that tax-exempt organizations report on their F990s and Schedules H. Users seeking explanations for unexpected numbers are encouraged to contact the tax-exempt organization directly.

Downloading data in the CBI database

The CBI's developers and sponsors are committed to making the underlying data available for researchers, graduate students, journalists, citizen scientists and others with legitimate interests in mining the data for other insights. For every tax-exempt organization and for each tax year, the user can download the fields in the database using an application programming interface (API).

At this time, it is not possible for the CBI to support a batch download containing all tax-exempt organizations across all tax years.

Limitations

It is possible that these methods overlooked some hospital facilities which appear on a Schedule H for a F990 filed by a tax-exempt organization, due to the ability to cross-reference names and addresses as they appear on multiple sources.

The CBI always shows the community benefit spending at the level of the tax-exempt organization, rather than the level of the facility, because that is what appears on Schedule H. When Schedule H Part 5 lists only one facility, it is safe to assume that the community benefit spending at the organization level is the same as what it would be at the facility level. However, as noted above, approximately 38% of hospital facilities are operated by organizations that operate multiple facilities, which means that all facilities the organization operates are listed together on the Schedule H. There is no facility-level spending information in such situations; there is only the spending at the level of the organization.

While it is possible to estimate facility-level spending, the CBI does not attempt to compute or display such estimates, given its commitment to showing exactly what appears on the tax returns that the organizations file with the IRS.

The tool does not attempt to "correct" or eliminate numbers that are unexpected.

Footnotes:

Across tax years, an average of 11% of facilities appeared on returns with two facilities; 13% of facilities appeared on returns with 3-6 facilities; 15% of facilities appeared on returns with 7 or more facilities. From the perspective of the tax-exempt organization, across tax years, the median percentage of organizations operating 1, 2, 3 to 6, and 7 or more facilities, was 82.5%, 9.3%, 6.1% and 2.2% respectively.